Table of Content

Indicate how soon you would like to start making additional payment, in months. Total amount of interest you will save by prepaying your equity line. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

The limit is based on the equity you have in your property. To qualify for a HELOC, lenders assess whether you have equity in your home , and other factors such as your credit score, credit history, and debt-to-income ratio. HELOC interest rates are often adjustable, with closing costs generally lower than conventional purchase home loans.

How much equity do I need to get a HELOC?

For example, a lender's 80% LTV limit for a home appraised at $400,000 would mean a HELOC applicant could have no more than $320,000 in total outstanding home loan balances. Remember, the $320,000 limit would include all existing loans secured by your home plus your new HELOC. Consider your realistic ability to repay the line of credit, particularly after the draw period. After all, paying a small monthly payment that takes care of the interest on your credit is relatively cheap. However, at the end of the draw period, the balloon payment for the value of the credit line is due. Borrowers then have the choice of either paying the balloon payment from their savings or taking out another loan to cover it.

You also can't be carrying too much debt – your total monthly debts, including your mortgage payments and all other loans, should not exceed 45 percent of your gross monthly income. Use this calculator to estimate monthly home equity payments based on the amount you want, rate options, and other factors. You may want to pay toward the principal each month even when you are still in the interest-only draw period. This will lower your principal so that, by the end of the draw period, your payments will be made on a lower amount. In addition, each time you lower your principal on a HELOC, you have the lowered amount available to you for use. Next, enter the total number of monthly payments you will make with a negative sign in front of it (so -120).

How to Convert a Bond Equivalent Yield to a Monthly Equivalent Yield

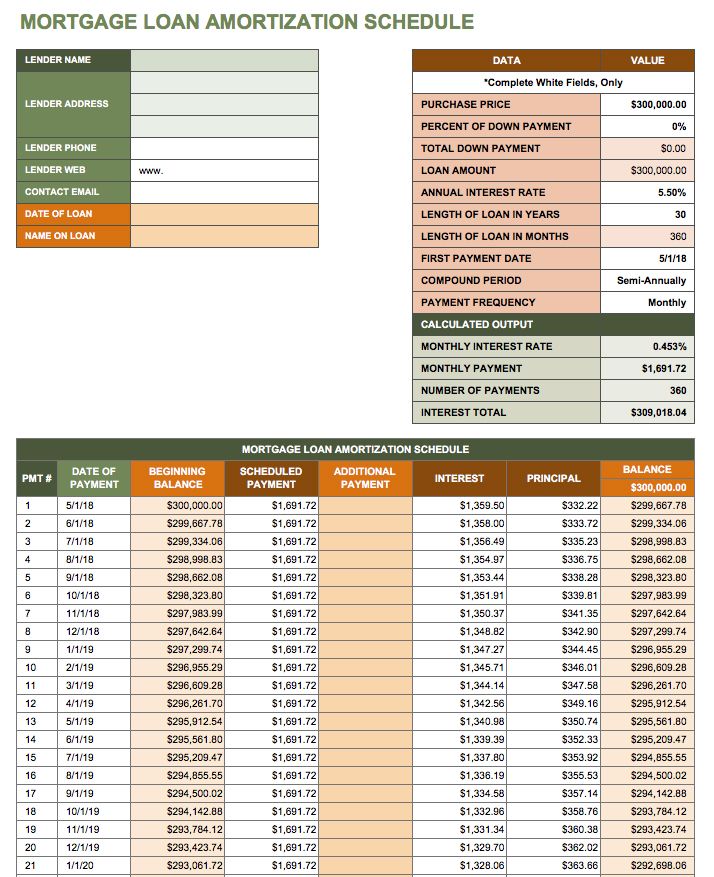

Note that this will have to be recalculated each month as interest rates will change. For example, if your HELOC is tied to the prime rate, which is currently at 3.5% and charges a 1.5% margin, your annual interest rate is 5%. There are usually ways to pay down your mortgage faster. Explore the options in your mortgage agreement or contact us for help.

This will give you the information you need to calculate your payments. This information includes your outstanding balance and interest rate charged. For example, imagine that you have a HELOC on which you currently have $20,000 drawn out. You are currently preparing to receive a bill for the month of April, so you will be paying interest for 30 days . Lenders don't like a high LTV because it suggests you could have too much leverage and might be unable to pay back your loans. During times of economic upheaval, they can tighten their lending standards.

HELOC Payment Calculator

Because HELOCs are drawn upon as needed, they are more flexible than second mortgages. This makes them a better choice if you are unsure how much money you will need. 2To qualify for a CIBC Home Power Plan Line of Credit, you must have more than 35% equity in your home. 1Less what you currently owe on your home under all encumbrances. For non owner-occupied rental properties of up to four units you can access up to 80%. Get expert help with accounts, loans, investments and more.

Still, some homeowners may want to access a portion of their home's equity to pay off high-interest credit cards or fund a home renovation project. The interest rate for home equity loans is typically higher than a rate-and-term-refinance, but could be a good option if it means avoiding higher-interest alternatives. For example, cash-out refinancing, which was all the rage when interest rates were near zero, is now nearly flatlined. Homeowners who snagged low-interest mortgages would end up paying much more interest if they were to refinance their loan into a new mortgage with a much higher rate. While down from October, the average interest rate for 30-year, fixed-rate mortgages stayed near record highs at 6.49% as of December 1, 2022, according to Freddie Mac. With mortgage rates rising, however, tapping your home's equity may come at a higher cost than it did just a few years ago.

However, the line of credit may have a maintenance fee until the credit line is borrowed upon and may or may not begin to charge interest immediately. Like a loan, a line of credit requires good credit to take out. A home equity line of credit provides you with a line of credit with a pre-approved limit . Also like a credit card, you can draw from and pay back into it whenever you want. There is, however, no grace period where you won’t be charged interest until a certain date – the moment you withdraw from the HELOC, interest starts accruing.

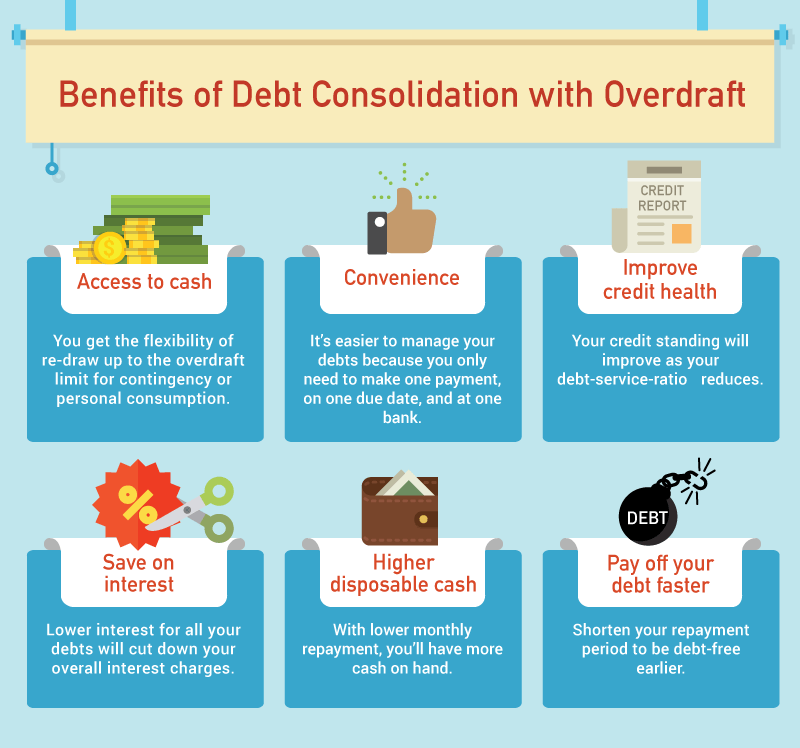

Just as important is whether the individual wants a fixed or variable interest rate for reasons previously discussed. The borrower will also want to factor in the current mortgage's interest rate. Using a HELOC to consolidate debt can end up being financially destructive if you are not careful. Doing so may cause you to run up more debt than you had originally.

Then use our Line of Credit Payments Calculator to figure your payments during the draw phase or our Home Equity Loan and HELOC Calculator to estimate payments over the entire loan. You can calculate home equity by subtracting the amount owed due to the mortgage from the current estimated value of the house. You may also make use of our Home Equity Line of Credit Calculator to determine further how much you can borrow based on your current home equity. At account opening, the Fixed-Rate Loan Option is available for a maximum of 90% of your line of credit. The amount has been adjusted automatically to a lower initial withdrawal for more accurate payment results. If discussing an adjustable rate with your loan agent, be sure that you are told what the interest cap will be.

Ibr sets your loan payments at 15% of what the government considers your “discretionary” income, if ... Use this calculator to determine the home equity line of credit amount you may qualify to receive. Whether you are looking to transform, transition or treat yourself, a home equity loan may be the option for you. Remodel or renovate your home, make those small home improvements, consolidate debt, take a vacation or even use the funds for college tuition.

With a HELOC, when carrying a balance, all that needs to be paid is the minimum interest unlike various loans. A lot of the time different forms of loans charge a penalty to pay off the principal. With a HELOC, you pay off the pricinpal without penalty.

Homeowners commonly use HELOCs to fund home improvements or other larger expenses. Repaying a Home Equity Line of Credit requires payment to the lender, which typically includes both repayment of the loan principal plus monthly interest on the outstanding balance. Some HELOCs allow you to make interest-only payments for a defined period of time, after which a repayment period begins. If you prefer a fixed interest rate, some lenders offer HELOCs that allow a fixed rate advance. A fixed-rate HELOC advance option allows you to lock in all, or a portion of, your HELOC balance at a fixed-rate. The fixed-rate advance feature ends your ability to draw against the fixed-rate line of credit balance.

You can find this on your most recent account statement, or by calling customer service for the bank that carries your credit line. This information will also be available on the bill for your monthly payment. A home equity loan is a lump sum of money with a fixed interest rate, so your monthly payments stay the same for the loan’s lifetime. It’s best if you need a large sum with predictable payments. The repayment period is when you have to start paying back the principal. Loan-to-value ratio is the percentage of your home's appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home.