Table of Content

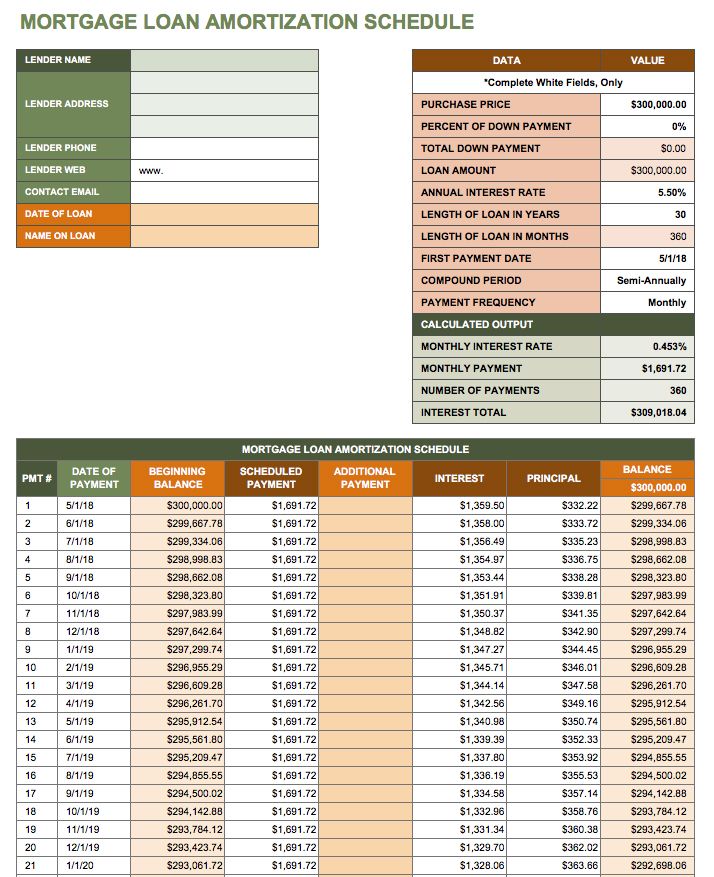

Once you lock in a HELOC balance at a fixed-rate, you begin repayment on the balance for a period of typically 1-10 years. It is worthwhile to shop around for competitive HELOC rates to find a HELOC lender with the best rate and terms for your financial circumstances. Your monthly payment may increase substantially during the repayment period, depending on your principal amount due, interest rate, and your repayment period.

It is important to note that interest-only payments will not pay off the amount borrowed, therefore a balloon payment will result. As noted above, home equity lines of credit are adjustable-rate loans during the interest-only draw phase. Since you can't predict what interest rates will do over time, you can't calculate exactly what your payments or interest charges will be if rates go up or down. Lines of credit can be offered to either individuals or to businesses. For individuals, the types of lines of credit include personal and home equity lines of credit .

Auto Loans

The range of home values are listed along the bottom and are centered on the value you entered; the figures for the available line of credit are listed at left on the vertical axis. We provide complimentary educational workshops on a broad range of topics. Also, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. These ads are based on your specific account relationships with us. We ask for your email address so that we can contact you in the event we're unable to reach you by phone.

In comparing these two options, the main differences are in the interest rates and in the repayment policies. The first step in considering one's best option in borrowing funds is to look at the specific details of each option. In this case, defining the differences between a home equity loan and a line of credit is essential, before looking at the particular advantages and drawbacks of each option. Discover offers a thorough definition for each choice, creating a great starting point for evaluating each homeowner's best choice. With financial discipline, a HELOC can be a great idea and here is why. One of the best uses of HELOC is to improve an existing asset to generate wealth.

Outstanding balance

Simply subtract your remaining mortgage from the home's value, and you'll come up with $100,000 in home equity. Home equity is the value of your ownership stake in your home, calculated by subtracting your outstanding mortgage from the property's market value. First Merchants provides third party links for your convenience. First Merchants is not responsible for the products, services, content, privacy policy, and security policy on third party websites. You can click Cancel now to stay on the current page.

It's essential to look for ways to mitigate your risk when you want to take out a chunk of equity to pay for a major project or purchase another home. Before applying for a new loan, speak with your lender about your budget and goals so you can work together to find the right option. It's also a wise practice to use a mortgage calculator to get a clearer view of how a mortgage loan could impact your budget. As is the case with the HELOC, the business line of credit shouldn't be used for anything more than a temporary fix to a short-lived problem.

HELOC Payoff Calculator

Furthermore, a recent appraisal or assessment placed the market value of your house at $250,000. You also still have $195,000 left on the original $200,000 loan. Remember, almost all of your early home mortgage payments go toward paying down interest. It is generally assumed that most people know what their home equity is. However, many people are still confused about the topic. As a homeowner, you need to understand how home equity works.

The HELOC limit calculator is for informational purposes only and the estimates are based on information you provide. Actual available HELOC credit lines are subject to individual lender underwriting criteria and will depend on a number of factors, including CLTV ratios and property valuations. Zillow Group Marketplace, Inc. does not make loans and this is not a commitment to lend. While second mortgages are more widely known, homeowners are showing greater interest in lines of credit. The use of HELOC accounts has risen steadily since 2012.

Your home equity gives you financial flexibility

Creating a better way of life means accessing tools to help you financially succeed. Financial peace of mind leads to success – and a better way of life. At Gate City Bank, we provide customers with fun, fast and FREE financial resources that are easy to digest. Our local, expert advisors at Gate City Investment Services are here to help navigate strategies for investments, retirement, college funding, insurance and more. Check out our current promotions and exclusive offers, all wrapped up for you to enjoy. A lender licensed in your state who offers HELOCs will call you as soon as possible.

The privacy policies and security at the linked website may differ from Regions’ privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information. Interest rates on HELOCs are typically higher than those on home equity loans. As you pay down your mortgage balance, the amount of your home equity usually increases.

Unlike a mortgage or home loan, it's a flexible line of credit and you can use it only when you need to. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80%, 90% and 100%; On the calculator, click on the. Having your insurance coverage on file with Mid Minnesota saves you money. If you change insurance carriers or recently bought your vehicle, update your insurance information to keep your payment low. Your home equity value is the difference between the current market value of your home and the total sum of debts registered against it. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice.

This means, unlike the fixed payments in a fixed-rate mortgage, a HELOC's rate is variable. So if a lender increases its prime rate, then your HELOC interest payment increases. The rates are typcially higher than the rate of the initial mortgage.

Then, it'll shift to a variable rate as low as 6.50% for the remainder of its life. In a low-interest environment, a cash-out refi can give you an infusion of cash while lowering your interest rate. But when rates rise, the interest rate on a new rate-and-term loan may be higher than that of your existing loan, making it a less desirable option to tap into your equity.

APR is variable and subject to change monthly but cannot exceed 18%, and the APR will never fall below 3.99% for HELOC 70%, 4.49% for HELOC 80%, 4.99% for HELOC 90% or 7.99% for HELOC 100%. HELOCs with credit limits exceeding $400,000 do not qualify for the introductory rate. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. You may take steps to strengthen your credit score by making consistent on-time payments on your credit accounts, keeping your balances low and following other credit-improving tips.

Home equity loans and HELOCs are two types of loans that use the value of your house as collateral. The main difference between them is that with home equity loans you get one lump sum of money whereas HELOCs are lines of credit that you can draw from as needed. Home Equity Loan - You can take out a home equity loan, which has a fixed rate, and use this new loan to pay off the HELOC. The advantage of doing this is that you could dodge those rate adjustments. The disadvantage is that you would be responsible for paying closing costs. This HELOC calculator is designed to help you quickly and easily calculate your monthly HELOC payment per your loan term, current interest rate, and remaining balance.

No comments:

Post a Comment